https://sarvjan.com/

Kotlin | Laravel

Android | Admin Panel

Overview

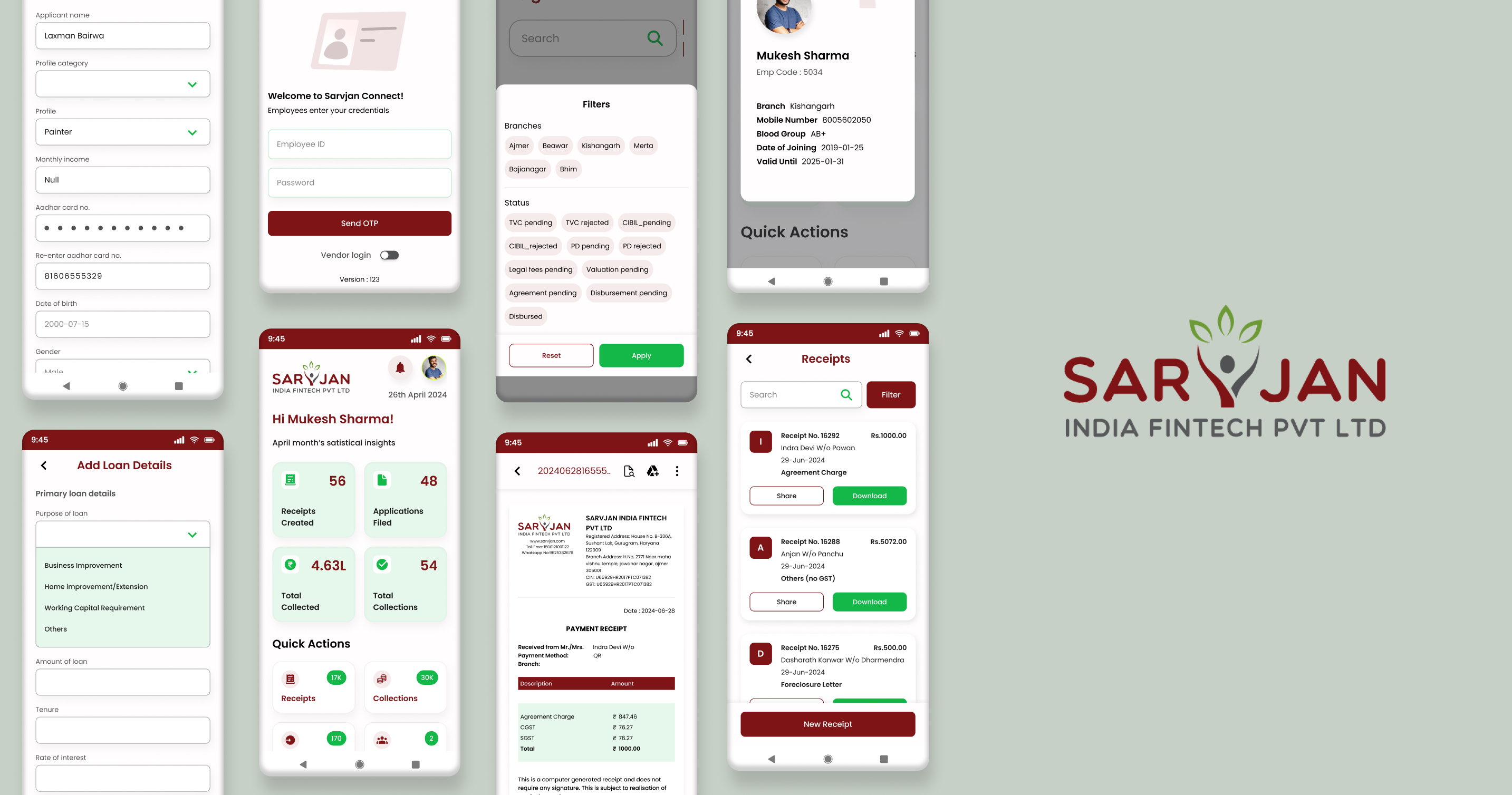

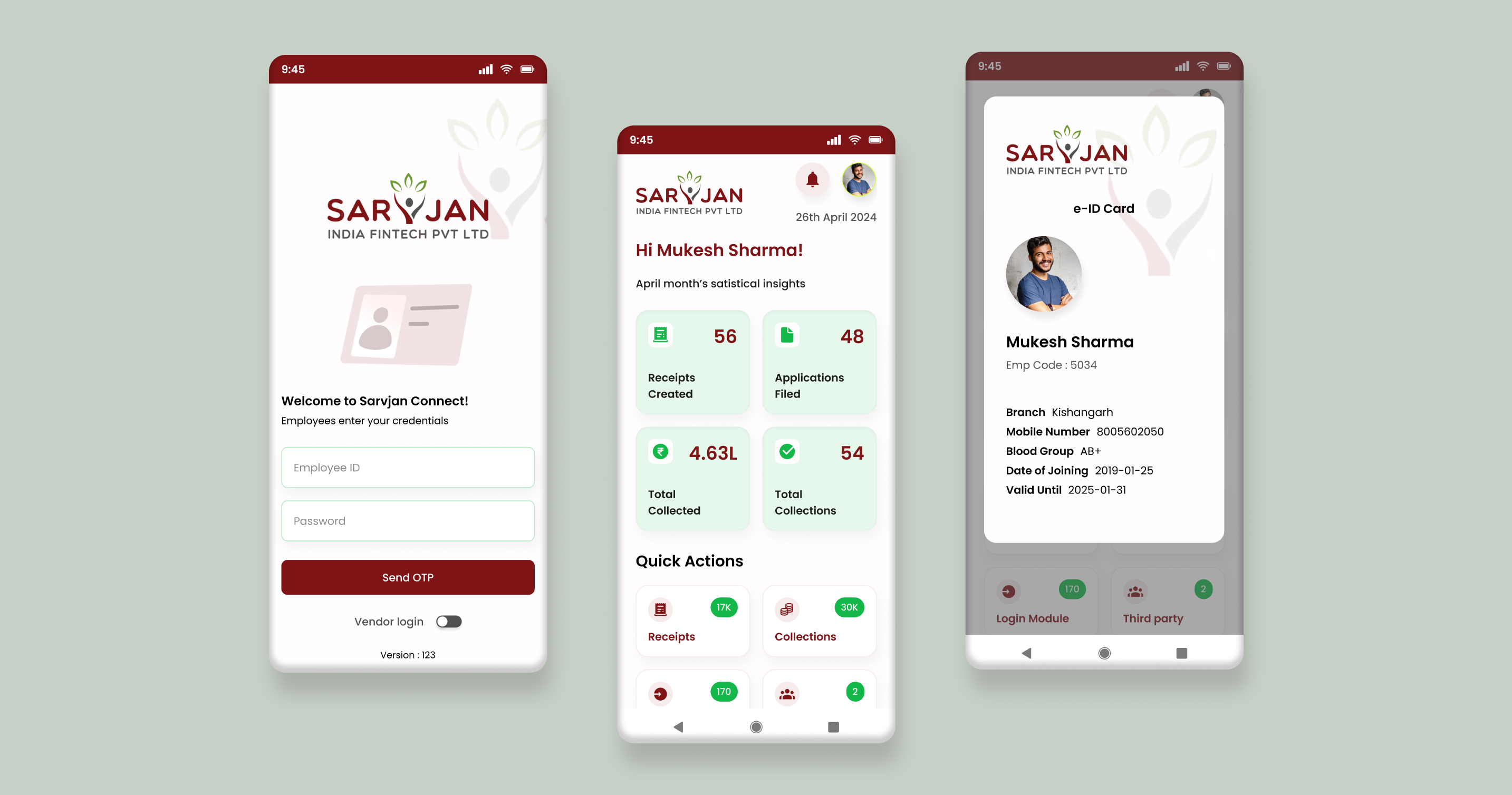

Sarvjan Connect is a comprehensive digital solution developed for Sarvjan India Fintech Pvt Ltd, a loan company focused on enhancing operational efficiency and reducing paperwork. The project includes an Android application built using Kotlin and a Laravel-based admin panel. The solution is designed to streamline various tasks and processes for Sarvjan employees, ensuring a seamless and efficient workflow.

About the client

Sarvjan India Fintech Pvt Ltd is a leading loan company providing a range of financial solutions to its customers. With a commitment to simplifying the borrowing process, the company offers various loan products and services tailored to meet diverse financial needs. To achieve greater operational efficiency and minimize the reliance on manual paperwork, Sarvjan India Fintech Pvt Ltd sought a digital solution capable of handling their complex business requirements effectively.

Our Role

At Itzak Technologies LLP, we took on the challenge of developing Sarvjan Connect to meet the specific needs of Sarvjan India Fintech Pvt Ltd. Our role encompassed the following key areas:

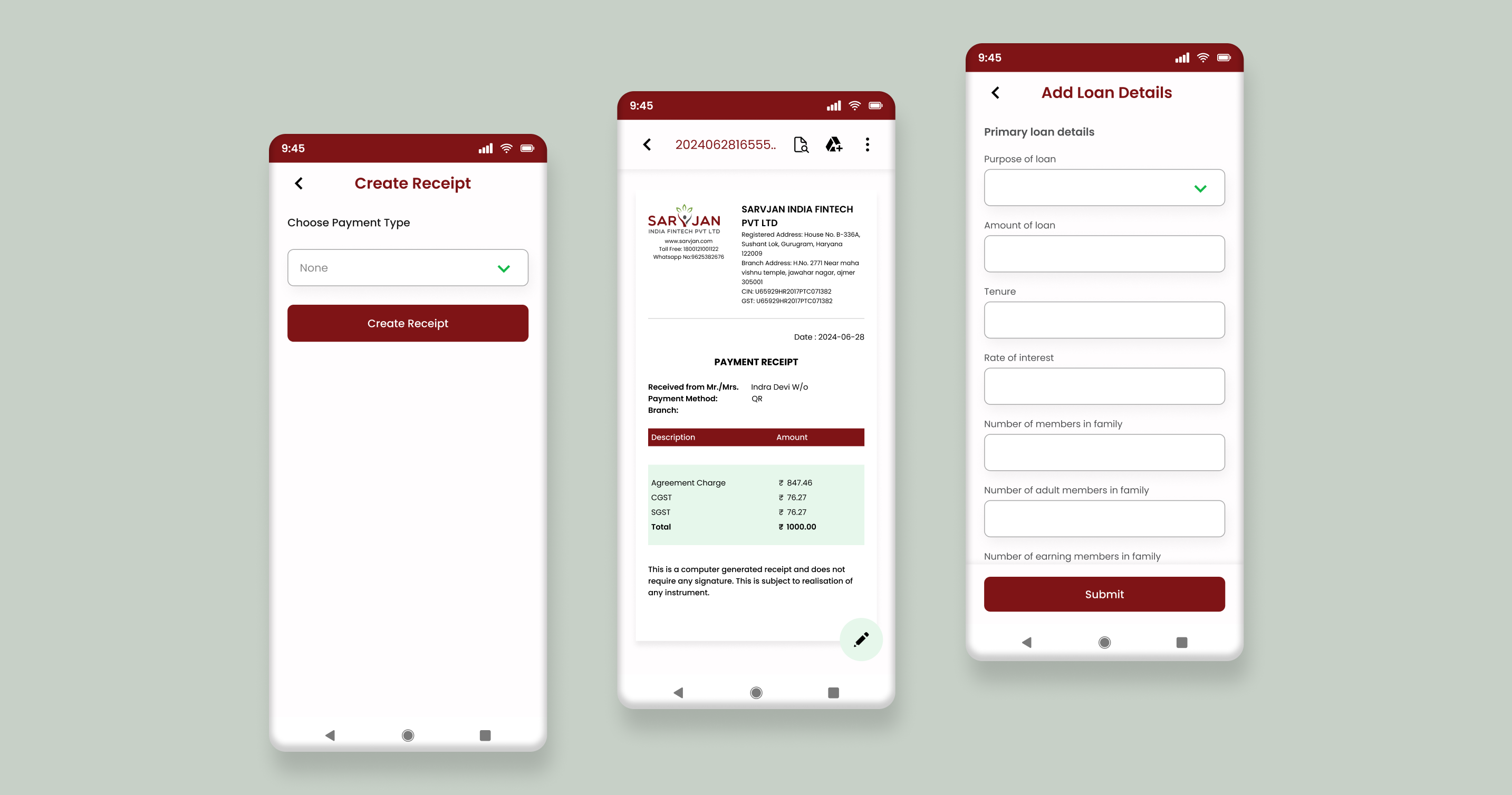

- Development of the Android App: Leveraging Kotlin, we built a user-friendly application designed to facilitate various tasks for Sarvjan employees. The app ensures a seamless user experience and efficient task management.

- Creation of the Admin Panel: Using Laravel, we developed a robust admin panel that offers comprehensive management capabilities across different modules. This panel allows administrators to oversee and manage various aspects of the business effectively.

- Implementation of Key Modules:

- Receipt Module: Digitizes the creation, storage, and sharing of receipts, including those for joining fees, EMI, and cheque bounce fees, promoting a paperless environment.

- Login/Application Module: Streamlines the onboarding and processing of loan applications, ensuring role-specific handling by different teams.

- Third Party Stock Management: Provides detailed inventory management, including branch-wise tracking of products, ensuring accurate records.

- Collection Module: Facilitates the monthly collection process with detailed sheets, customer contact information, and payment status tracking.

- Branch Module: Manages branch details, including manager contact information, office area, and asset records.

- Petty Cash Module: Records and monitors small expenses for each branch, ensuring transparent management of monthly budgets.

- Cash Deposit Module: Tracks cash deposits made by employees, including entries and deposit slip images.

Target Audience

The primary target audience for Sarvjan Connect includes:

- Sarvjan Employees: The app is designed to facilitate various operational tasks, enhancing productivity and reducing the manual workload for employees.

- Branch Managers: The admin panel helps managers oversee branch operations, inventory, and employee activities, ensuring efficient management.

- Operational Teams: Teams involved in loan processing, collections, and inventory management benefit from streamlined workflows and digital record-keeping.